Critics of the supply-side tax cuts proposed by the Reagan administration argued that lower taxes would:

a. increase the budget deficit.

b. decrease money supply in the economy.

c. reduce the aggregate price level.

d. reduce the disposable income of households.

e. reduce the volume of international trade.

a

You might also like to view...

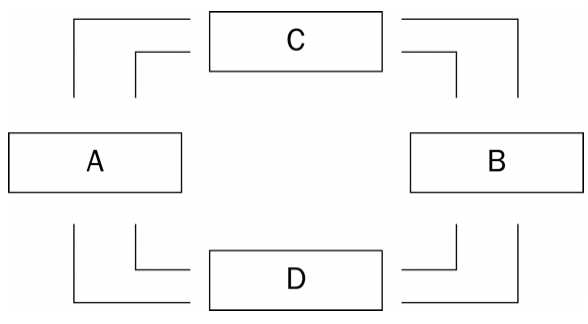

Refer to the figure below. In response to gradually falling inflation, this economy will eventually move from its short-run equilibrium to its long-run equilibrium. Graphically, this would be seen as

A. long-run aggregate supply shifting leftward B. Short-run aggregate supply shifting upward C. Short-run aggregate supply shifting downward D. Aggregate demand shifting leftward

Assume a firm is run as a zero-profit enterprise. Which of the following would be true?

A) There is a higher probability that wage reductions would outweigh layoffs. B) Those in charge would not act any different than regular owners, there would still be layoffs. C) Those not in charge would remain risk neutral. D) Wage reductions would be lower than they would be if the firm was run for profit.

Refer to Figure 1. The figure represents a circular-flow diagram. Boxes A and B represent

a. firms and households.

b. households and government.

c. the markets for goods and services and the financial markets.

d. the markets for goods and the markets for services

The market demand schedule or curve for a product shows the relationship between how much of the product buyers are willing and able to buy and the:

A. Product's price B. Buyers' incomes C. Cost of producing the product D. Time period, say, from one month to the next