Describe the relationship between the production function, the investment function, and the capital-labor ratio

What will be an ideal response?

Financial markets operate to ensure that the level of savings equals the level of investment. For simplicity, we assume that the economy saves a constant fraction, s, of real GDP per worker, y. So, investment per worker, i, equals sy. As the capital-labor ratio increases, real GDP per worker also increases, which causes investment per worker to increase. Due to diminishing marginal returns, increasing the capital-labor ratio causes smaller and smaller increases in real GDP per worker, so the production function becomes flatter. Because investment per worker equals the saving rate multiplied by real GDP per worker, sy, the increase in investment also gets smaller and smaller as the capital-labor ratio increases.

You might also like to view...

Refer to Table 14-6. What price will Sturdy Homes charge and what profit does Sturdy Homes expect to make?

A) Price = $12,000; expected profit = $3 million B) Price = $8,000; expected profit = $7 million C) Price = $8,000; expected profit = $4 million D) Price = $10,000; expected profit = $5 million

There are several factors that nearly everyone agrees have contributed to economic growth in some or all countries. They do not include which of the following?

a. Growth in the quantity and quality of labor resources used b. Increase in the use of inputs provided by the land c. Growth in physical capital inputs d. All of the above are included.

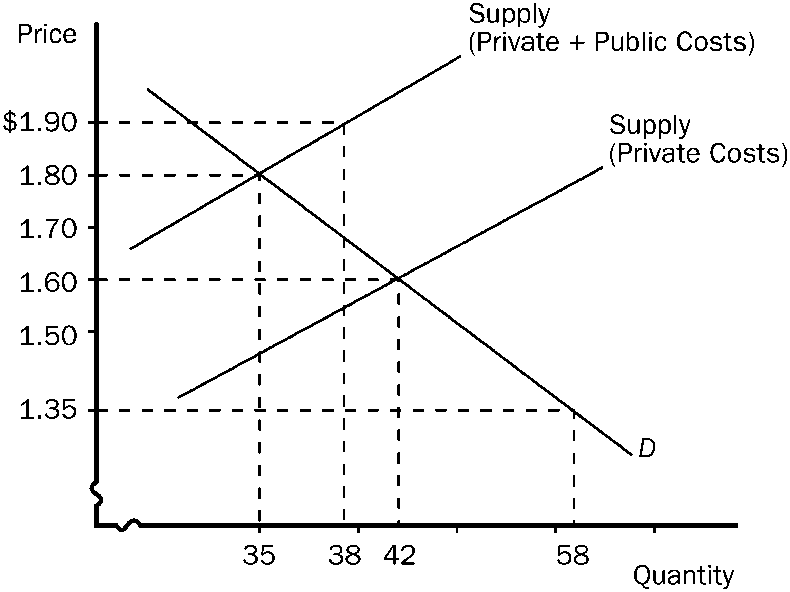

Figure 5-4

Refer to . If the government uses a pollution tax, how much of a tax must be imposed on each unit of production?

a.

$1.90

b.

$1.80

c.

$1.60

d.

$0.30

Which is true with respect to the demand data confronting a monopolist?

A. Demand is perfectly price inelastic. B. Price increases as the output of the firm increases. C. Marginal revenue is less than price. D. Marginal revenue increases as price decreases.