According to your textbook authors, monetary calculation would improve if

A) the government subsidizes business production.

B) the Fed sought to establish monetary equilibrium.

C) Congress seeks to establish a budget surplus.

D) domestic producers are protected from foreign competition.

B

You might also like to view...

Refer to Figure 10.3. An increase in the real interest rate, with no other changes that affect aggregate expenditure, is best represented by ________ in panel (a) and ________ in panel (b)

A) a shift from AE2 to AE3; a shift from IS1 to IS2 B) a shift from AE3 to AE2; a shift from IS2 to IS1 C) a shift from AE2 to AE1; a movement from point B to point A D) a shift from AE3 to AE1; a movement from point C to point A

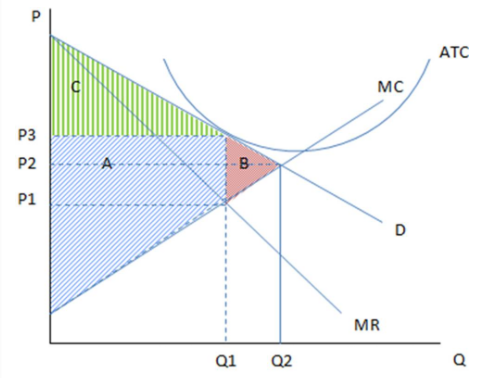

If the firm in the given graph were to maximize profits, it would:

These are the cost and revenue curves associated with a firm.

A. produce Q1 and charge P3.

B. cause deadweight loss.

C. earn zero economic profits.

D. All of these statements are true.

Concepts useful in evaluating the costs and benefits of alternative types of taxes are:

A. efficiency, incidence and scarcity. B. revenue, scarcity, and shortage. C. incidence, scarcity, and shortage. D. efficiency, revenue and incidence.

When a firm faces a downward-sloping demand curve, marginal revenue

a. is constant regardless of how much output the firm produces b. is less than price c. increases as the firm produces more output d. decreases if the firm produces less output e. is equal to the price per unit of output