When law-makers impose ceilings on the amount of annual interest charged by lenders, their actions have the effect of

A) excluding certain borrowers from the legally regulated credit market.

B) expanding retail sales.

C) increasing the number of loans made.

D) lowering interest rates for most borrowers.

E) redistributing income from creditors to debtors.

A

You might also like to view...

A sales tax imposed on sellers shifts the supply curve leftward for the taxed good because the

A) tax is paid by the seller to the government and is, therefore, like a cost of production. B) tax is actually shifted entirely onto the buyer who can afford only a smaller supply. C) higher price causes entry into the market. D) tax shifts the demand curve leftward.

International trade is advantageous because trade makes it possible for people in each country to

a. import more than they export. b. export more than they import. c. employ more of their domestic resources producing things that are costly for them to produce domestically. d. acquire goods from foreigners more economically than they could be produced domestically. e. do all of the above.

Analysis of the Great Depression indicates that

a. even though monetary and fiscal policies were highly expansionary, they were unable to offset the economic downturn. b. even though monetary policy was expansionary, restrictive fiscal policy dominated during the 1930s. c. a reduction in tax rates could not prevent the economic downturn from spiraling into a depression. d. the depth of the economic plunge, if not its onset, was the result of monetary, fiscal, and regulatory policies.

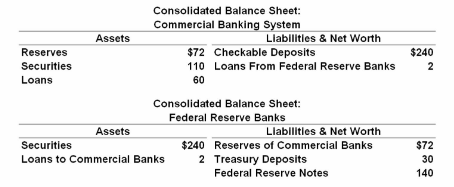

Refer to the given balance sheets and assume the reserve ratio is 25 percent. Suppose the Federal Reserve Banks sell $2 in securities directly to the commercial banks. As a result of this transaction, the supply of money:

A. will decrease by $2, but the money-creating potential of the commercial banking system

will not be affected.

B. is not directly affected, but the money-creating potential of the commercial banking system

will decrease by $8.

C. will directly increase by $2 and the money-creating potential of the commercial banking

system will decrease by an additional $8.

D. will directly increase by $2 and the money-creating potential of the commercial banking

system will increase by an additional $8.