On January 1, Year 3, Dartmouth Corporation paid $18,000 for major improvements on a two-year-old manufacturing machine. Although the expenditure did not change the expected useful life, it greatly increased the productivity of the machine. Prior to this transaction, the machine account in the general ledger was listed at $84,000, and the accumulated depreciation account was $20,000. Dartmouth uses the straight-line method. The estimated useful life was six years, and the estimated salvage value was $4,000.Required: a) Prepare the entry in general journal form for the January 1, Year 3 transaction.b) Immediately after the January 1, Year 3 transaction, what is the book value of the asset on Dartmouth books?c) Compute the depreciation for the machine for Year 3.

What will be an ideal response?

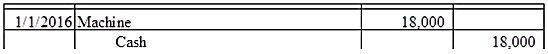

a)

b) 82,000

Book value = Cost of $84,000 ? Accumulated depreciation of $20,000 + Capital expenditure of $18,000 = $82,000

c) $19,500

Year 3 Depreciation = (Book value of $82,000 ? Estimated salvage value of $4,000) ÷ 4 years = $19,500

You might also like to view...

The Internet has changed the quality of information available to make purchase decisions.

Answer the following statement true (T) or false (F)

Implementing a strategy is straightforward; there are usually only a limited number of ways things can go wrong.

Answer the following statement true (T) or false (F)

The duties of a trustee are:

A) to carry out the purposes of the trust. B) to act with prudence and care in the administration of the trust. C) to exercise a high degree of loyalty toward the beneficiary. D) All of these.

The yield curve is flat at 6% per annum. What is the value of an FRA where the holder receives interest at the rate of 8% per annum for a six-month period on a principal of $1,000 starting in two years? All rates are compounded semiannually

A. $9.12 B. $9.02 C. $8.88 D. $8.63