The price of a computer in the United States is $1,000. The price of a car in Germany is 10,000 euros. The current exchange rate is 0.9 euros per dollar

a) If a computer is exported from the United States to Germany with no barriers to trade, what will be the price of the computer in Germany? b) If a car is imported to the United States from Germany with no barriers to trade, what will be the price of the car in the United States? c) Suppose the dollar appreciates by 10 percent against the euro. How will the price of a computer exported from the United States change in Germany? d) Suppose the dollar appreciates by 10 percent against the euro. How will the price of a car imported to the United States from Germany change in the United States?

a) The price of an American computer in Germany is $1,000 × 0.9 euros per dollar, which is 900 euros.

b) The price of a German car in the United States is 10,000 euros/0.9 euros per dollar = $11,111.

c) The new exchange rate is 0.9 euros per dollar × 1.1 = 0.99 euros per dollar. So the new price of a U.S. computer in Germany is $1,000 × 0.99 euros per dollar = 990 euros. The price of a U.S. computer in Germany rises by 10 percent.

d) The new price of a German car in the United States is 10,000 euros/0.99 euros per dollar = $10,101. So the price of a German car in the United States falls by about 10 percent.

You might also like to view...

One World View article is titled "Glaring Inequalities." Of the countries listed, the least inequality in the distribution of income is likely to occur in

A. South Africa. B. Japan. C. Botswana. D. United States.

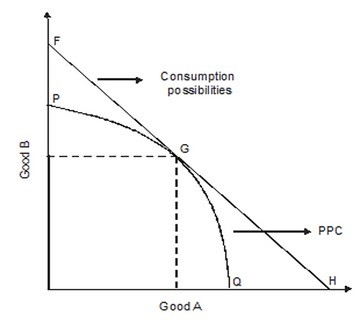

Refer to the following graph. With free trade, this country's citizens can consume the greatest amount of both good A and good B if the country produces at point

With free trade, this country's citizens can consume the greatest amount of both good A and good B if the country produces at point

A. P. B. G. C. F. D. H.

Suppose that the quantity of good y is measured along the vertical axis and that the quantity of good x is measured along the horizontal axis. If the price of good x is $5 and the price of good y is $10 when income is $200 per time period, the slope of

the consumer's budget constraint will be A) -0.5. B) -2. C) -5. D) -10.

When the Fed acts as a "lender of last resort", like it did in the financial crisis of 2007-2008, it is performing its role of:

A. Controlling the money supply B. Setting the reserve requirements C. Being the bankers' bank D. Providing for check clearing and collection