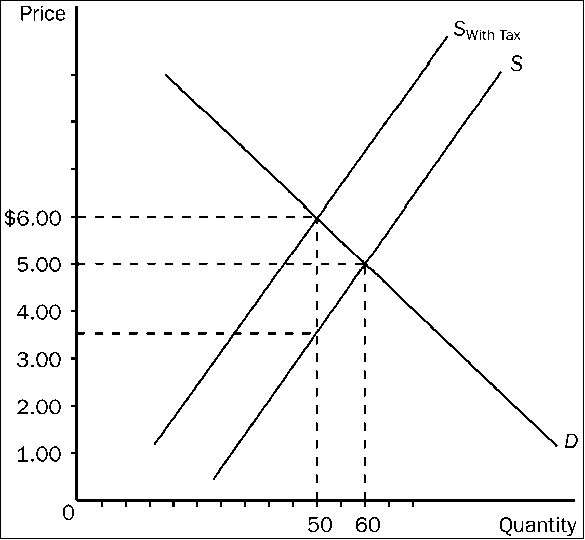

Figure 4-22

Refer to . From this tax the government will collect a total of

a.

$125.00.

b.

$175.00.

c.

$200.00.

d.

$250.00.

a

You might also like to view...

If an established domestic industry is in jeopardy of being displaced by lower-priced imports, there could be a rationale for

a. permanent import restrictions to prevent the decline of the domestic industry b. temporary import restrictions to allow the orderly adjustment of the domestic industry c. permanent import restrictions based on the infant industry argument d. temporary import restrictions based on the infant industry argument e. temporary import restrictions that will be replaced by permanent tax breaks for the domestic industry

Fiscal policy is

A) the money supply policy that the Fed pursues to achieve particular economic goals. B) the spending and tax policy that the government pursues to achieve particular macroeconomic goals. C) the investment policy that businesses pursue to achieve particular macroeconomic goals. D) the spending and saving policy that consumers pursue to achieve particular macroeconomic goals. E) none of the above

When your broker sees that you are in danger of running through your money and forces you to sell your stock and use the money to pay back your loan, he is making a:

A. margin call. B. stock sales call. C. futures call. D. leverage call.

Suppose real GDP is $12.1 trillion and potential GDP is $12.6 trillion. To move the economy back to potential GDP, Congress should

A) lower taxes by an amount less than $500 billion. B) raise government purchases by $500 billion. C) raise government purchases by more than $500 billion. D) lower taxes by $500 billion. E) lower government purchases by $500 billion.