A state tax assessed specifically on cigarettes is an example of

A. a consumption tax.

B. an excise tax.

C. a tariff.

D. a social tax.

Answer: B

You might also like to view...

The minimum wage is set above the equilibrium wage rate. Does the minimum wage create inefficiency?

A) Yes B) No C) Only if the supply of labor is perfectly inelastic D) Only if the supply of labor is perfectly elastic E) Only if employment exceeds the efficient amount

Fluctuations in employment and output result from changes in

a. aggregate demand only. b. aggregate supply only. c. aggregate demand and aggregate supply. d. neither aggregate demand nor aggregate supply.

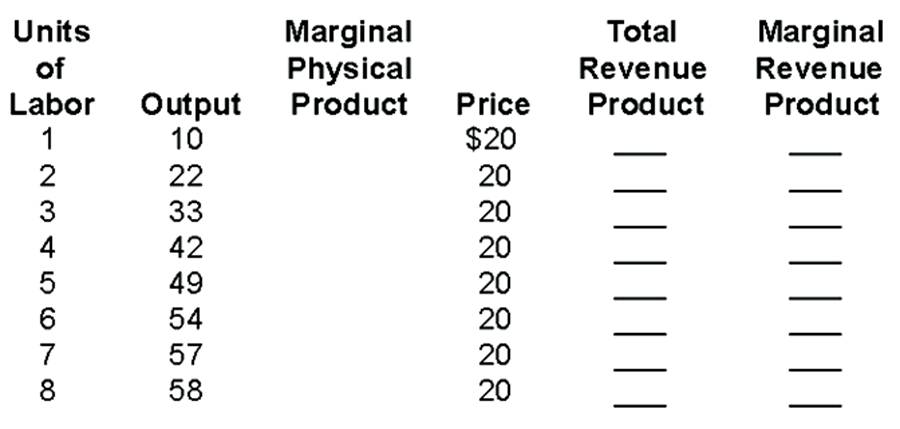

(a) Fill in Table. (b) Is the firm a perfect or an imperfect competitor? Explain. (c) If the wage rate were $220, how many workers would be hired? How much would the total wage bill come to? (d) If the wage rate were $100, how many workers would be hired? How much would the total wage bill come to? (e) How many workers would be hired if the wage rate were $50? (f) How many workers would the firm want to hire if the wage rate were $0?

Two firms, Acme and FirmCo, have access to five production processes, each of which has a different cost and gives off a different amount of pollution. The daily costs of the processes and the corresponding number of tons of smoke emitted are shown in the table below.ProcessABCDE(smoke/day)(4 tons/day)(3 tons/day)(2 tons/day)(1 tons/day)(0 tons/day)Cost to Acme ($/day)$750$800$1,000$1,400$2,000Cost to FirmCo ($/day)$500$750$1,200$2,200$4,000 Suppose the firms are both currently using process A. If the government requires each firm to reduce pollution by 20 percent, then the firms will adopt process ________, and a total of ________ tons of smoke will be emitted each day.

A. B; 16 B. A; 18 C. D; 8 D. C; 12