In order to profit from an expected near-term increase in the relative value of the British pound

versus the U.S. dollar, an investor would be wise to maintain a short position in pounds, then sell

when the pound rises in relative value.

Indicate whether the statement is true or false

FALSE

You might also like to view...

The ________ were developed in the manufacturing economy of the 1960s when large consumer goods were serving mass markets

A) 4 Ps B) 7 Ps C) 12 variables D) 4 Cs E) 7 Cs

Kilduff Corporation's balance sheet and income statement appear below:Comparative Balance Sheet Ending BalanceBeginning BalanceAssets: Cash and cash equivalents$36 $38 Accounts receivable 36 32 Inventory 49 55 Property, plant and equipment 707 580 Less accumulated depreciation 316 315 Total assets$ 512 $ 390 Liabilities and stockholders' equity: Accounts payable$71 $64 Accrued liabilities 22 19 Income taxes payable 34 41 Bonds payable 71 100 Common stock 32 30 Retained earnings 282 136 Total liabilities and stockholders' equity$ 512 $ 390 Income StatementSales$ 1,174Cost of goods sold 771Gross margin403Selling and administrative expense 146Net operating income257Gain on sale of plant and equipment

14Income before taxes271Income taxes 81Net income$ 190The company sold equipment for $19 that was originally purchased for $10 and that had accumulated depreciation of $5. The company paid a cash dividend of $44 and it did not issue any bonds payable or repurchase any of its own common stock.The net cash provided by (used in) financing activities for the year was: A. $2 B. $(44) C. $(71) D. $(29)

The Sarbanes-Oxley Act of 2002 established the Public Company Accounting Oversight Board (PCAOB) which is a not-for-profit corporation that oversees auditors of public corporations

Indicate whether the statement is true or false

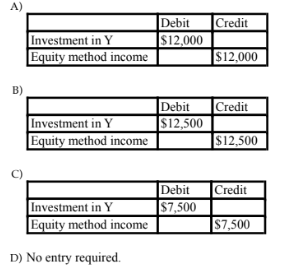

Which of the following journal entries would have to be made to record X's share of Y's net income for 2016?

On January 1, 2016, X Inc. purchased 25% of the voting shares of Y Inc. for $100,000. The investment is reported using the equity method, as X has significant influence over Y. Y's net income and declared dividends for the following three years are as follows: