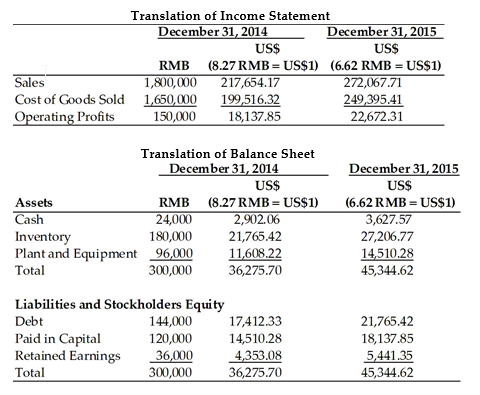

A U.S-based MNC has a subsidiary in China where the local currency is the Renminbi (RMB). The balance sheets and income statements of the subsidiary are presented in the table below. On December 31, 2014, the exchange rate was 8.27 RMB/US$. Assume the local currency figures in the statement below remain the same on December 31, 2015. Calculate the U.S. dollar translated figures for the two ending time periods assuming that between December 31, 2014 and December 31, 2015, the Chinese government revalues (appreciates) the RMB by 20 percent.

This shows that an appreciation of the foreign currency against the dollar for a subsidiary in that country will result in higher values on both the balance sheet and income statement once those values are translated into dollars even if the local currency values didn't change at all. The opposite would be the case if the foreign currency depreciates against the dollar.

You might also like to view...

The standard bank confirmation includes the confirmation of cash accounts but not liabilities with financial institutions

a. True b. False Indicate whether the statement is true or false

Columbia Sportswear makes nylon activewear. Its marketing manager set a goal to use greater promotional efforts to increase by 12 percent over the next three years the sales of the company's line of comfortable, lightweight clothing for people who fish. Columbia Sportswear's marketing manager is engaged in ________.

A) portfolio planning B) strategic planning C) scorecard balancing D) mass marketing E) tactical planning

The basis for both U.S. GAAP and IFRS requirements for income tax accounting for financial reporting purposes focuses on which of the following financial reporting objectives?

a. recognizing the amount of taxes payable in the current year, only. b. recognizing deferred tax assets and deferred tax liabilities for the future income tax consequences of temporary differences, only. c. recognizing the amount of taxes payable in the current year, and recognizing deferred tax assets and deferred tax liabilities for the future income tax consequences of temporary differences. d. recognizing deferred tax assets and deferred tax liabilities for the future income tax consequences of permanent differences, only. e. recognizing the amount of taxes payable in the current year, and recognizing deferred tax assets and deferred tax liabilities for the future income tax consequences of permanent differences.

The reason employees behave unethically at times is usually for ______ gain, to avoid getting into trouble, or because they don’t believe the rules apply to them.

A. cultural B. organizational C. personal D. societal