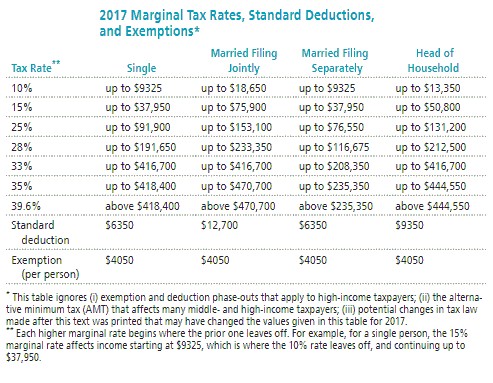

Solve the problem. Refer to the table if necessary. Carmen and James are married and filed jointly. Their combined wages were $88,560. They earned a net of $2146 from a rental property they own, and they received $1692 in interest. They claimed four exemptions for themselves and two children. They contributed $4113 to their tax-deferred retirement plans, and their itemized deductions total $10,460. Find their adjusted gross income.

Carmen and James are married and filed jointly. Their combined wages were $88,560. They earned a net of $2146 from a rental property they own, and they received $1692 in interest. They claimed four exemptions for themselves and two children. They contributed $4113 to their tax-deferred retirement plans, and their itemized deductions total $10,460. Find their adjusted gross income.

A. $77,825

B. $84,901

C. $106,971

D. $88,285

Answer: D

You might also like to view...

Solve the equation for the unknown quantity.6z + 13 = 5z + 5

A. -8 B. -18 C. 8 D. 18

Solve the problem.Suppose your after-tax income is $42,667. Your annual expenses are $25,996 for rent, $6979 for food and household expenses, $1234 for interest on credit cards, and $7977 for entertainment, travel, and other. You expect to get a 25% raise next year. Could you afford $4113 in tuition and fees without going into debt?

A. No B. Yes

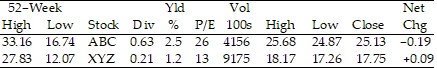

Use the given stock table to answer the question.How much profit per share did company XYZ earn in the past year?

A. $1.21 B. $1.16 C. $1.37 D. $1.45

Decide whether the statement makes sense. Explain your reasoning.Juan won't have to pay any taxes this year. The profit from his business was less than the amount of the standard deduction.

What will be an ideal response?