What procedure has to be completed at or after the end of the period?

a. Assessment of control risk.

b. Engagement letter.

c. Evaluation of adjusting journal entries.

d. All procedures must be completed prior to period end.

c

You might also like to view...

Which of the following is not true?

a. Large-scale IT outsourcing involves transferring specific assets to a vendor b. Specific assets, while valuable to the client, are of little value to the vendor c. Once an organization outsources its specific assets, it may not be able to return to its pre-outsource state. d. Specific assets are of value to vendors because, once acquired, vendors can achieve economies of scale by employing them with other clients

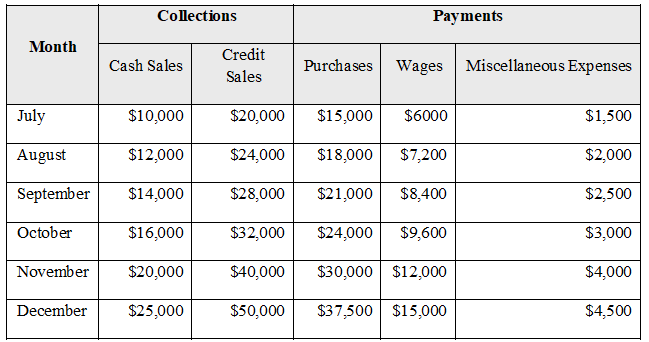

The Right Target, Inc., a marketing research and consulting firm, is working on a cash budget for July to December 2017. The staff has projected the following cash collections and payments:

a) If the ending cash balance as of June 30, 2017 was $10,000, determine the firm’s forecasted monthly cash balance.

b) The staff at The Right Target, Inc. wants to know how much they would need to borrow each month if the minimum ending cash balance is $30,000 and the annual interest rate is 7%.

c) Determine the impact on the ending cash balance if the firm uses any cash surplus above the required minimum cash balance to pay off its short-term borrowing monthly.

Which of the following statements is incorrect?

A. Accepting a special order will involve incurring unit-level costs. B. Eliminating a business segment often allows a company to avoid some facility-level costs. C. An outsourcing decision typically affects only product-level costs. D. Facility-level costs generally are not relevant in special order decisions.

Lakeland Corporation reported the following pretax (and taxable) information for 2016: Income from continuing operations $550,000 Loss on disposal of Segment B 45,000 Prior period adjustment-Depreciation was understated in 2015 15,000 Gain from operations of discontinued Segment B 35,000 Income tax rate 35% ? Required: a.Prepare the lower portion of Lakeland's 2016 income statement, beginning with pretax income for continuing operations. (Omit the heading.)b.Prepare Lakeland's 2016 statement of retained earnings, assuming that retained earnings at January 1, 2016, was $750,000 and the company paid $45,000 of dividends in 2016. (Omit the heading.)

What will be an ideal response?