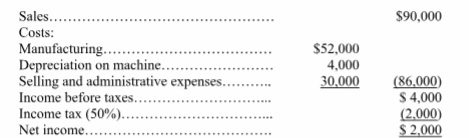

A company is planning to purchase a machine that will cost $24,000 with a six-year life and no salvage value. The company expects to sell the machine's output of 3,000 units evenly throughout each year. A projected income statement for each year of the asset's life appears below. What is the accounting rate of return for this machine?

A) 33.3%.

B) 16.7%.

C) 50.0%.

D) 8.3%.

E) 4%.

B) 16.7%.

Explanation: Accounting rate of return = $2,000/[($24,000 + $0)/2] = 16.7%

You might also like to view...

According to the textbook, Revlon cosmetics uses ________ pricing.

A. everyday low B. above-market C. below-market D. prestige E. at-market

Erica, a vice president of human resources at an automobile company, wants to develop its programs for employee empowerment. However, she is concerned because unions are heavily involved in representing auto workers and might object to empowerment programs. Which statement about the National Labor Relations Board would best address Erica's concern?

A. In its rulings, the NLRB has allowed employee empowerment in certain very limited situations. B. The NLRB has issued statements indicating that it will not tolerate employee empowerment. C. In its rulings, the NLRB has shown clear support for employee involvement in decision making. D. The NLRB has issued rulings that say employee empowerment is allowed only in a nonunion environment. E. The NLRB makes it an unfair labor practice to form employee participation committees to make decisions.

The first step in creating effective advertising messages is ________

A) selecting specific media vehicles B) planning a message strategy C) determining return on advertising investment D) choosing media timing E) executing the message

Greg owns a small business of selling athletic equipment to retailers. He spends $12,500 annually on transportation. His annual fixed cost is $19,000. His other annual expenses total $4,000. His annual sales are $130,000 and the cost of the goods he sells is $65,000. Calculate Greg's direct costs and his break-point point.

What will be an ideal response?