An appliance store has total assets of $2,800,000, accounts receivable of $900,000, accounts payable of $700,000, inventory valued at $1,500,000, and total liabilities of $2,500,000. In 2016, its net sales were $2,100,000, and its operating profit margin equaled $42,000. Calculate the store's return on assets.

A. 2.8 percent

B. 7.5 percent

C. 1.5 percent

D. 71.4 percent

E. 75 percent

Answer: C

You might also like to view...

Which of the following is the first step in customer value analysis?

A) Examine how customers in a specific segment rate the company's performance. B) Assess the company's and competitors' performances on the different customer values against their rated importance. C) Identify the major attributes and benefits that customers value. D) Monitor customer values over time. E) Assess the quantitative importance of the different attributes and benefits.

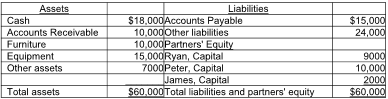

Ryan, Peter, and James share profits 3:2:1. They liquidate the partnership. The furniture and equipment are sold at a $8000 loss. The accounts receivable were collected in full and the other assets were written off as worthless. The liabilities were paid off at book value. James argued that he should receive a portion of the remaining cash, but Ryan and Peter disagree. How much cash should James receive or pay?

The balance sheet of Ryan, James and Peter's partnership as of December 31, 2018, is given below.

A) He should receive $1500.

B) He should not receive or pay any money.

C) He should pay $55,500.

D) He should pay $500.

Timothy volunteers to take on a heavy research assignment for his group project, even though he likely won’t be able to complete the assignment in time. No one else was willing to take the assignment, and Timothy felt that the needs of the group are far more important than his own needs. What conflict-handling style is Timothy employing?

a. obliging b. dominating c. compromising d. integrating

Use the following information to calculate the free cash flow of Jarvis, Inc.

Net cash provided by operating activities, $25,000 Net cash provided by financing activities, $35,000 Net cash used for planned investment in long-term assets, $12,000 Net cash used for investing activities, $20,000 Cash dividends paid, $10,000.