Small firms frequently run into problems when:

A. they offer equipment as collateral for a term loan.

B. they under-utilized the equipment purchased with the loan.

C. they overestimate the cash inflows from the equipment purchased with the loan.

D. they faiil to match a term loan's payment terms with the expected cash inflows from the equipment purchased with the loan.

Answer: D

You might also like to view...

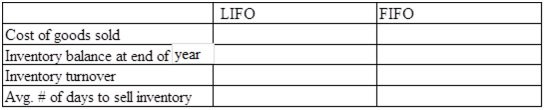

The following information relating to the current year was taken from the records of Poole Company: Beginning inventory200 units @ $110Purchase May 12100 units @ $120Purchase October 9150 units @ $125Sales360 units @ $180Required: a) Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to cost of goods sold, and how much to inventory at the end of the year. b) Based on your results from part (a), calculate inventory turnover and average number of days to sell inventory. c) Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to inventory at the end of the year. d) Based on your results from part (c), calculate inventory turnover and average number of

days to sell inventory. e) Compare your results from parts (b) and (d). Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

What will be an ideal response?

In a joint venture, the parent company in the United States retains complete ownership and authority over all phases of the operation

a. True b. False Indicate whether the statement is true or false

_____ is the bargaining between buyers and sellers on product specifications, delivery dates, payment terms, and other pricing matters and is commonplace in business marketing.

A. Negotiation B. Need mediation C. Customerization D. Purchase arbitration E. Disintermediation

You are considering building a new deck on your home, what factors should you consider when deciding whether to borrow the money or take the money out of your savings account?

A) You should compare the after-tax return on your savings with the after-tax APR on your loan. B) It's simple, if you can afford to pay cash then you should not take out the loan. C) What impact the savings withdrawal will have on your liquidity. D) Both A and C are correct.