Dell ranks highest on the list for expecting returns from new investments.

Answer the following statement true (T) or false (F)

True

This is true according to the disruptive versus sustaining technology figure.

You might also like to view...

Provide an example of a study that would be analyzed using a t-test for dependent samples.

What will be an ideal response?

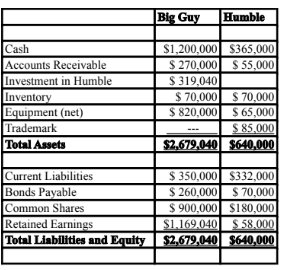

The amount of Non-Controlling Interest on Big Guy's consolidated balance sheet on July 1, 2017 would be:

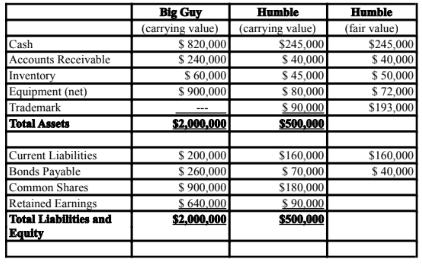

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2017. On that date, Humble Corp. had Common Shares and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2027. Both companies use straight line amortization, and no salvage value is assumed

for assets. The trademark is assumed to have an indefinite useful life.

Goodwill is tested annually for impairment. The balance sheets of both companies, as well as Humble's fair market values on the date of acquisition are disclosed below:

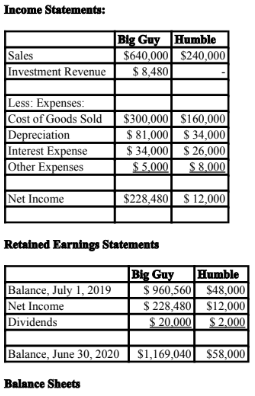

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2020:

An impairment test conducted in September 2018 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2020, Humble Inc. borrowed $20,000 in cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in

Humble Corp. Assume that the entity method applies.

A) $270,000.

B) $0.

C) $90,000.

D) $88,000.

A standing plan that outlines the steps to be followed in a particular circumstance is called a(n)

A. standard operating procedure. B. single-use plan. C. program. D. contingency plan. E. project.

A ___________ metropolitan area network uses radio signals to transmit and receive data.

Fill in the blank(s) with the appropriate word(s).