Sally purchased new equipment for her consulting business. She allocates the Section 179 deduction among the new assets. One piece of equipment costs $1,020,000 and was allocated one-half of the allowable Section 179 deduction and therefore has a depreciable basis of $510,000.

Answer the following statement true (T) or false (F)

True

You might also like to view...

A foreign company has offered to buy 85 units for a reduced sales price of $350 per unit. The marketing manager says the sale will not affect the company's regular sales. The sales manager says that this sale will require variable selling and administrative costs. The production manager reports that it would require an additional $30,000 of fixed manufacturing costs to accommodate the specifications of the buyer. If Belfry accepts the deal, how will this impact operating income? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

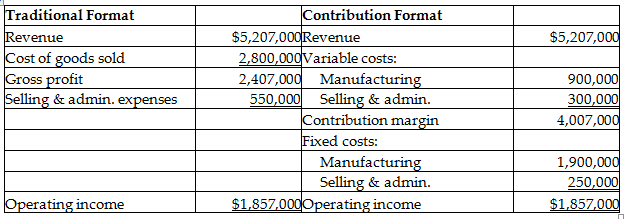

Belfry Company makes special equipment used in cell towers. Each unit sells for $410. Belfry produces and sells 12,700 units per year. They have provided the following income statement data:

A) Operating income will increase by $8282.

B) Operating income will decrease by $8282.

C) Operating income will increase by $29,750.

D) Operating income will decrease by $21,719.

Retailers normally have a much lower degree of conversion than do manufacturing or professional firms

Indicate whether the statement is true or false

Title VII of the Civil Rights Act of 1964 prohibits only intentional discrimination

Indicate whether the statement is true or false

An agreement in connection with the sale of a business that prohibits the seller from engaging in the same or a similar business for a period of twenty-five years would be unreasonable

Indicate whether the statement is true or false