What is the equivalent tax-exempt bond yield for a taxable bond with an 8% yield and a bondholder in a 35% marginal tax rate? Explain.

What will be an ideal response?

5.20%. The tax-exempt bond yield = (Taxable bond yield) × (1 - tax rate). Substituting; The tax exempt bond yield = (8%) × (1 - 0.35) = 5.20%

You might also like to view...

Refer to Table 2-13. What is Tammi's opportunity cost of bathing a cat?

A) two groomed dogs B) one and a half groomed dogs C) two-thirds of a groomed dog D) half a groomed dog

Refer to Figure 15-2. The firm's profit-maximizing price is

A) P1. B) P2. C) P3. D) P4.

Which of the following is not true for the GDP deflator?

A. It typically reveals a lower inflation rate than the CPI. B. It refers to all goods and services produced in GDP. C. It reflects both price changes and market responses. D. It is based on a fixed basket of goods and services.

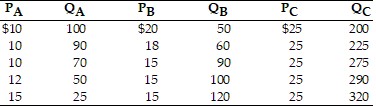

Refer to the above table. The price of B decreases from $18 to $15. What is the cross price elasticity of demand between B and A?

Refer to the above table. The price of B decreases from $18 to $15. What is the cross price elasticity of demand between B and A?

A. -1.0 B. -0.73 C. +1.83 D. +1.38