Consider the following scenario. Assume the price of gold in London is selling for $1400 an ounce while in New York it is fetching a price of $1450 an ounce

What would an economist say about the efficiency of this market? What would an economist predict about what would happen next?

An economist would argue that this market is currently not efficient. The reason is that there are still profit opportunities to be had. Market participants could buy gold in London and sell it in New York until there is no more incentive to do so, i.e. (when there are no more profit opportunities).

You might also like to view...

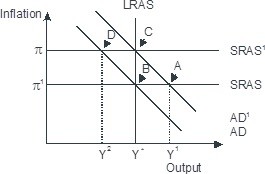

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

Where does equilibrium occur in an income expenditure diagram? What would be the effect if production is at either on the left or right side of the equilibrium point?

What will be an ideal response?

During the first 6 months of 2008, the United States imported from Africa, Asia, and Latin America more than 1.6 billion pounds of coffee and did not export any coffee

How is the gain from imports distributed between consumers and domestic producers? A) U.S. producer surplus shrinks. B) U.S. consumer surplus increases. C) Total U.S. surplus increases. D) All the above answers are correct.

If the deficit is increasing because of the effects of automatic stabilizers, _____

a. the budget is annual balanced b. the economy is contracting c. the annual deficit will approach zero d. the budget is cyclically balanced e. the economy is growing