Income tax was $400,000 for the year. Income tax payable was $30,000 and $40,000 at the beginning and end of the year. Cash payments for income tax reported on the cash flow statement using the direct method is

A) $400,000

B) $390,000

C) $430,000

D) $440,000

B

You might also like to view...

The conscious or unconscious attempt to control images in social situations is:

A) crisis management B) enhancement C) social responsibility D) impression management

During January of Year 1, Sports World experienced the following business events. The company uses the perpetual inventory system. 1) Jan 3. Purchased $10,000 of merchandise from a supplier, Apex Athletic Shoes. The terms of the purchase: 2/10, n/30 and FOB shipping point.2) Jan 5. Paid $275 cash for freight to trucking company to have goods shipped from Apex.3) Jan 7:(a) Sold merchandise for $1,500 to a customer on account. (b) The merchandise had cost Sports World $900.4) Jan 10. Returned $1,100 of defective shoes to Apex. 5) Jan. 11: (a) Recorded the cash discount on the goods purchased in Event 1(b) Paid amount due on account to Apex for merchandise purchased on Jan. 3.6) Jan. 12: (a) Accepted a return of $375 of the goods sold on Jan. 7. (b) The cost of these goods was

$225.Required:Record the events in general journal format. What will be an ideal response?

Which of the following is a plausible marketing observation?

A) Marketing managers must spend a considerable amount of time talking to customers. B) New competitors' actions are easier to predict than existing competitors' actions. C) Customers can always tell you what products they want and what features they need. D) Unlike general societal trends, changes in customer tastes occur frequently.

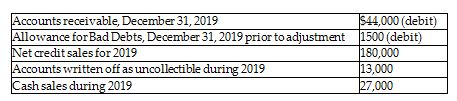

The following information is from the 2019 records of Uptown Antique Shop:

Bad debts expense is estimated by the percent-of-sales method. Management estimates that 4% of net credit sales will be uncollectible. The ending balance of the Allowance for Bad Debts account after adjustment will be ________.

A) $8700

B) $6780

C) $9780

D) $5700