We worry that false negatives occur too often relative to false positives due to

a. Most hypotheses being false

b. It being appropriate to set a high standard for acceptance of a hypothesis

c. Managers having an incentive to make a false negative conclusion because they are harder for superiors to observe

d. They are not too common

c

You might also like to view...

A free market can be defined as a market structure where all exchanges are voluntary, and prices are free to fluctuate. Does a perfectly competitive market qualify as a free market?

What will be an ideal response?

Which of the following is NOT a reason financial regulation and supervision is difficult in real life?

A) Financial institutions have strong incentives to avoid existing regulations. B) Unintended consequences may happen if details in the regulations are not precise. C) Regulated firms lobby politicians to lean on regulators to ease the rules. D) Financial institutions are not required to follow the rules.

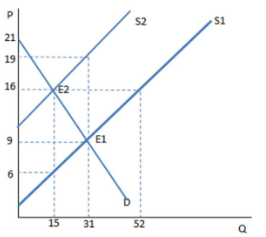

Does a tax on sellers affect the supply curve?

A. Yes, it shifts to the left by the amount of the tax.

B. Yes, it shifts to the right by the amount of the tax.

C. Yes, it shifts up by the amount of the tax.

D. No, there is change in the quantity supplied, but the supply curve does not move.

In a 100-percent-reserve banking system, if people decided to decrease the amount of currency they held by increasing the amount they held in checkable deposits, then

a. M1 would increase. b. M1 would decrease. c. M1 would not change. d. M1 might rise or fall.