"Given that labor remains relatively immobile within Europe, the European Union's success in liberalizing its capital flows may have worked perversely to worsen the economic stability loss due to the process of monetary unification." Discuss

What will be an ideal response?

Probably right. This is another example of the theory of the second best. If the Netherlands suffers an unfavorable shift in output demand, Dutch capital can flee abroad, leaving even more unemployed Dutch workers behind than in the case of government regulations that were to hinder the movement of capital outside the Netherlands. Severe and persistent regional depressions could result, worsened by the likelihood that the relatively few workers who did successfully emigrate would be precisely those who are most skilled, reliable, and enterprising.

You might also like to view...

When regulating a natural monopoly, government officials

a. can set an efficient price, but the firm will suffer a loss b. can arrange a Pareto improvement by leaving the firm alone c. should force the firm to set a price equal to minimum marginal cost d. should force the firm to set a price equal to minimum long-run average total cost e. will increase efficiency if they force the firm to produce where MR = MC.

An oligopoly can be characterized by production of either identical goods or differentiated goods.

Answer the following statement true (T) or false (F)

In the long run, a year-long drought that destroys most of the summer's wheat crops causes permanently:

A. higher prices. B. lower prices. C. lower output. D. None of these is true.

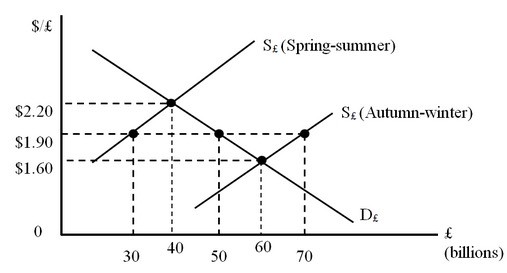

The figure below shows the foreign exchange market. D£ is the nonofficial demand curve for pounds. S£ (Spring-summer) and S£ (Autumn-winter) are the nonofficial supply curves of pounds during the spring-summer and autumn-winter seasons, respectively. Assume that the British government is committed to maintaining a fixed exchange rate at $1.90 per pound. In the Autumn-winter period, what type of intervention must British monetary authorities engage in?

A. Buy 20 billion pounds at $1.90 B. Sell 60 billion pounds at $1.60 C. Sell 20 billion pounds at $1.90 D. Buy 10 billion pounds at $1.60