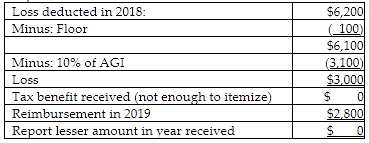

Constance, who is single, lives in an area that suffered a major hurricane which was declared a federal disaster. Her car sustained $6,200 in damages. Constance does not expect to recover any of the loss from her insurance company. Constance's 2018 AGI is $31,000. Her casualty loss is $3,000; she has other itemized deductions of $5,200. In 2019, Constance's insurance company reimburses her

$2,800. Constance's 2019 AGI is $28,000. As a result, Constance must

A) amend the 2018 return to show the $200 loss.

B) do nothing and simply keep the $2,800.

C) amend the 2018 return to show $0 loss and file her 2019 return to show $200 loss.

D) do nothing to the 2018 return but report $2,800 of income on her 2019 return.

B) do nothing and simply keep the $2,800.

You might also like to view...

Which of the following is NOT a reason the marketing program should build customer equity?

A. Expected profits depend on customer equity. B. Profit growth comes from customers. C. Customers are the source of revenue. D. Marketing strategies do not contribute to customer equity. E. Firms expect financial returns.

To be enforceable, any assignment covered by the Statute of Frauds must be in writing.

Answer the following statement true (T) or false (F)

In 2014, online bill payment accounted for ________ of all bill payments, while paper checks accounted for ________

A) less than 10%; less than 25% B) about 25%; about 10% C) more than 50%; less than 25% D) 100%; 0%

You collect a sample of n = 16 and want to know if the sample is significantly smaller than the population. If ? is unknown and ? = .05, what is the appropriate critical value?

a. -1.645 b. -1.960 c. -1.753 d. -1.746