Financial markets enable the transfer of risk by:

A. making sure that higher default risk is offset by greater liquidity.

B. enabling even unsophisticated investors to purchase highly complex financial instruments.

C. requiring that risk-averse investors have access to U.S. Treasury bond markets.

D. allowing individuals and firms less willing to bear risk to transfer risk to other individuals and firms more willing to bear risk.

Answer: D

You might also like to view...

If a price ceiling is set above the equilibrium price, then

A) there will be a surplus of the good. B) there will be a shortage of the good. C) there will be neither a shortage nor a surplus of the good. D) the price ceiling will generate revenue for the government. E) the price ceiling affects suppliers but not demanders.

Social costs are

A) costs that are borne by the government. B) the full cost borne by society whenever a resource use occurs. C) borne by individuals who incur them. D) another term for external costs.

Which of the following is an example of opportunity cost?

A. The income that could have been earned by working full-time instead of going to college. B. The decline in the grades of a student athlete that occurs because she decides to spend more time practicing sports than on her academic work. C. The value of other things you could have done with the same time and money it cost you to go to the movies. D. All of the choices are examples of opportunity cost.

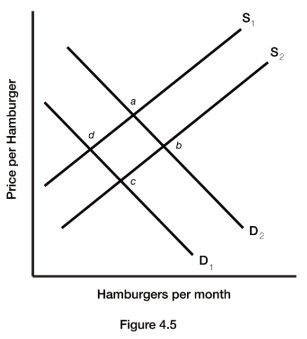

Figure 4.5 illustrates a set of supply and demand curves for hamburgers. A decrease in supply and a decrease in demand are represented by a movement from:

Figure 4.5 illustrates a set of supply and demand curves for hamburgers. A decrease in supply and a decrease in demand are represented by a movement from:

A. point c to point a. B. point b to point d. C. point d to point a. D. point a to point b.