The Antitrust Division of the Department of Justice carefully scrutinizes mergers. Why?

Mergers can lead to an increase in market power, which can lead to the abuses of that power discussed in the text. In a market in which concentration is high and/or entry is difficult (the market is not contestable), a merger can have adverse consequences for buyers of the good or service. Under these conditions, the Department of Justice will often oppose a merger. Guidelines that indicate whether the Department of Justice is (or is not) likely to seek to block a merger were loosened in announcements in 1982, 1984, and 1991, compared to original guidelines dating from 1968 . Although mergers can have public benefits (such as permitting economies of scale or scope, or "synergism" when two firms bring special skills or resources together, or permit a reduction in risk), critics have pointed out that not all mergers actually have the expected benefits. To the extent that a merger may affect economic well-being, government should pay attention to merger activity.

You might also like to view...

The expected benefit of investment equals:

A. the real interest rate. B. private saving. C. the price of the capital good. D. the value of the marginal product of capital.

When the marginal product of an additional worker is less than the marginal product of the previous worker, there are ________ returns to labor

A) increasing total B) decreasing total C) increasing marginal D) decreasing marginal E) constant average

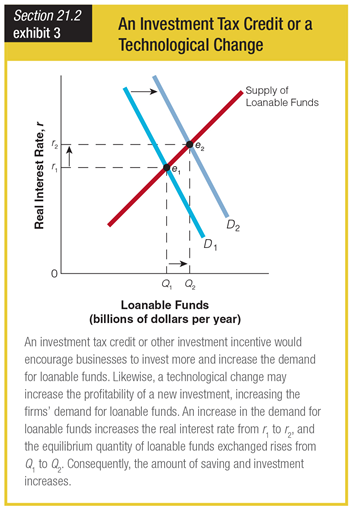

Based on the graph showing the effects of an investment tax credit or a technological change, eliminating an investment tax credit would ______.

a. create a negative real interest rate

b. have little or no effect on the real interest rate

c. increase the real interest rate

d. decrease the real interest rate

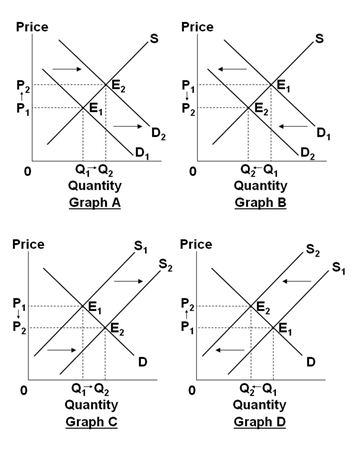

Select the graph below that best shows the change in the market specified in the following situation: In the market for gasoline, when the price of oil, which is used to produce gasoline, increases because of reduced production by major oil-producing

nations.

Assume that the graphs show a competitive market for the product stated in the question.

A. Graph A

B. Graph B

C. Graph C

D. Graph D