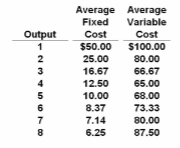

Refer to the data. The average total cost of five units of output is:

A. $69.

B. $78.

C. $3.

D. $10.

B. $78.

You might also like to view...

According to the case, price has a disproportionate effect on the bottom line relative to

A) demand changes. B) total and fixed costs. C) capital expenditures. D) the cost of capital.

Jessica owns a company that makes pre-packaged sandwiches for convenience stores. The market price for a sandwich is $5 and Jessica is a price-taker. Her daily variable cost for making sandwiches is C(Q) = 2.5Q + (Q2/40) and her marginal cost is MC = 2.5 + (Q/20). She is currently producing sandwiches according to the quantity rule. What should Jessica do if she has an avoidable fixed cost of $50 a day?

A. She should keep producing sandwiches because the price is greater than the minimum of average fixed cost. B. She should keep producing sandwiches because she is maximizing profit at the current quantity. C. She should shut down production because the price is greater than the minimum of average cost. D. She should shut down production because the fixed cost can be avoided if she does.

In perfect competition, one result of the model was that there were no economic profits in the long run. In a monopoly, the firm typically earns a positive economic profit. Why is there this difference?

If a union argues that a price cut will boost revenues of the firm and management argues that the opposite is true, then the price elasticity of demand is:

A. perfectly inelastic from the union's perspective and perfectly elastic from management's perspective. B. inelastic from the union's perspective; elastic from management's perspective. C. elastic from the union's perspective; inelastic from management's perspective. D. unit-elastic from the union's perspective and unit-inelastic from management's perspective.