Advertising is used mostly by ________

A) governments

B) business firms

C) social agencies

D) independent professionals

E) not-for-profit organizations

B

You might also like to view...

If a preliminary report concludes that the business situation warrants investment in a new IS, a more comprehensive _____ might be authorized.

Fill in the blank(s) with the appropriate word(s).

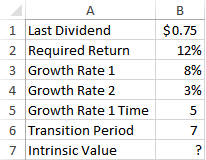

The last dividend payment of a stock was $0.75 and this dividend is expected to grow at 8% per year for three years. After that, the dividend will grow at 3% indefinitely. Assume that the transition between 8% and 3% will be gradual rather than instantaneous. The transition period is 3 years. Using the H-Model, what is the correct formula for B7 if the required rate of return on this stock is 12%?

a) =B1/(B2-B4*(1+B4+B5+B5+B6)/2*(B3-B4))

b) =(B1/(B2-B4)*(1+B4+(B5+B6)/2*(B3-B4)))

c) =(B1/(B2+B4)*(1-B4-(B5-B5-B6)/2*(B3+B4)))

d) =(B1/(B2-B3)*(1+B2+(B5+B5+B6)/2*(B4-B3)))

e) =(B1/(B2-B4)*(1+B4+(B5+B5+B6)/2*(B3-B4)))

Of the three levels of moral development, where do most people fall?

A. Preconventional B. Conventional C. Postconventional D. Multiconventional

The Jack Company began its operations on January 1, 2016, and used the LIFO method of accounting for its inventory. On January 1, 2018, Jack Company adopted FIFO in accounting for its inventory. The following information is available regarding cost of goods sold for each method: ? LIFO Cost of FIFO Cost of Year Goods Sold Goods Sold 2016 $470,000 $350,000 2017 690,000 450,000 2018 700,000 540,000 Assuming a tax rate of 35% and the same accounting change adopted for tax purposes, how would the effect of the accounting change be reported in opening retained earnings on the 2018 financial statements?

A. +$360,000 restatement B. +$234,000 restatement C. -$700,000 restatement D. no restatement