What is the difference between the M1 and M2 definitions of the money supply?

What will be an ideal response?

Both M1 and M2 are definitions of the economy’s money supply. M1 is the definition of the money supply with the highest degree of liquidity, the money supply used mainly for transactions purposes. M1 consists of currency (coins and paper money) and check able deposits. M2 consists of everything in M1 plus savings deposits, including money-market deposit accounts, small time deposits, and money-market mutual fund balances held by individuals.

You might also like to view...

A bank's net interest margin is

A) total interest income minus total interest expense. B) net interest income as a percent of bank equity. C) net interest income as a percent of total bank assets. D) net interest as a percent of total income.

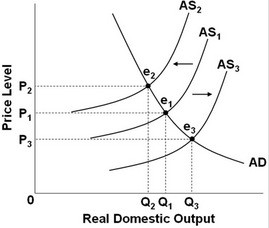

Refer to the above diagram. Cost-push inflation can be illustrated by a:

Refer to the above diagram. Cost-push inflation can be illustrated by a:

A. shift in the aggregate supply curve from AS2 to AS3. B. shift in the aggregate supply curve from AS1 to AS3. C. shift in the aggregate supply curve from AS1 to AS2. D. movement along the aggregate demand curve from e1 to e3.

Proponents of the real business cycle model argue that the short-run aggregate supply curve is

A) flat. B) positively sloped. C) vertical. D) negatively sloped.

In order to have an efficient distribution of final products to households,

A. households must maximize their income. B. there can be no unemployment. C. the equity criterion must be satisfied. D. free and open markets are essential.