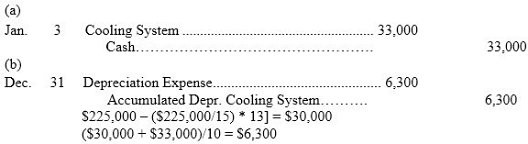

A company purchased a cooling system on January 2 for $225,000. The system had an estimated useful life of 15 years. After using the system for 13 full years, the company completed a renovation of the system at a cost of $33,000 and now expects the system to be more efficient and last 8 years beyond the original estimate. The company uses the straight-line method of depreciation.(a) Prepare the journal entry at January 3, to record the renovation of the cooling system.(b) Prepare the journal entry at December 31, to record the revised depreciation for the thirteenth year.

What will be an ideal response?

You might also like to view...

Myers Manufacturing uses a standard cost system. The allocation base for overhead costs is direct labor hours. Standard and actual data for manufacturing overhead are as follows:

Variable overhead allocation rate: $30 per direct labor hour Fixed overhead allocation rate: $10 per direct labor hour Actual overhead incurred (variable and fixed): $45,600 Standards for direct labor are as follows: Hours per unit 0.5, Direct labor cost per hour $18.00 Actual direct labor for the month: 1,200 hours for a total cost of $24,000 Actual and planned production for the month: 3,000 units Prepare the journal entry to allocate overhead cost (both variable and fixed) to production.

You may deduct an IRA investment only if you itemize expenses

Indicate whether the statement is true or false.

A(n) ____________________ is a Web application that combines features or information from more than one source.

Fill in the blank(s) with the appropriate word(s).

The United Nations Convention on Contracts for the International Sale of Goods (CISG) is the uniform international sales law of countries that account for more than two-thirds of all global trade

Indicate whether the statement is true or false