Section 2-306 of the UCC expressly disallows output contracts in the sale of goods.

Answer the following statement true (T) or false (F)

False

You might also like to view...

An expenditure for which of the following items would be considered a revenue expenditure?

a. Plant assets b. Ordinary repair c. Addition d. Betterment

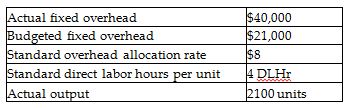

Family Fashions uses standard costs for its manufacturing division. The allocation base for overhead costs is direct labor hours. From the following data, calculate the fixed overhead volume variance.

A) $16,800 F

B) $46,200 U

C) $46,200 F

D) $16,800 U

Which of the following statements regarding the balanced scorecard approach is false?

A) Because of changing technology, global competition, and an increased awareness of the need to focus on customer needs, nonfinancial and qualitative performance measures have become an integral component of effective managerial decision making. B) The balance scorecard approach integrates both financial and nonfinancial performance measures. C) The balanced scorecard approach requires looking at performance from four different but related perspectives: financial, customer, internal business, and learning and growth. D) The balance scorecard approach is not as useful for performance measurement as traditional accounting measures.

On September 12, Ryan Company sold merchandise in the amount of $5,800 to Johnson Company, with credit terms of 2/10, n/30. The cost of the items sold is $4,000. Ryan uses the periodic inventory system and the net method of accounting for sales. On September 14, Johnson returns some of the non-defective merchandise, which is restored to inventory. The selling price of the returned merchandise is $500 and the cost of the merchandise returned is $350. The entry or entries that Ryan must make on September 14 is (are):

A.

| Sales returns and allowances | 500 | |

| Accounts receivable | 500 |

B.

| Sales returns and allowances | 350 | |

| Accounts receivable | 350 |

C.

| Sales returns and allowances | 490 | |

| Accounts receivable | 490 | |

| Merchandise inventory | 343 | |

| Cost of goods sold | 343 |

D.

| Sales returns and allowances | 490 | |

| Accounts receivable | 490 |

E.

| Sales returns and allowances | 490 | |

| Accounts receivable | 490 | |

| Merchandise inventory | 350 | |

| Cost of goods sold | 350 |