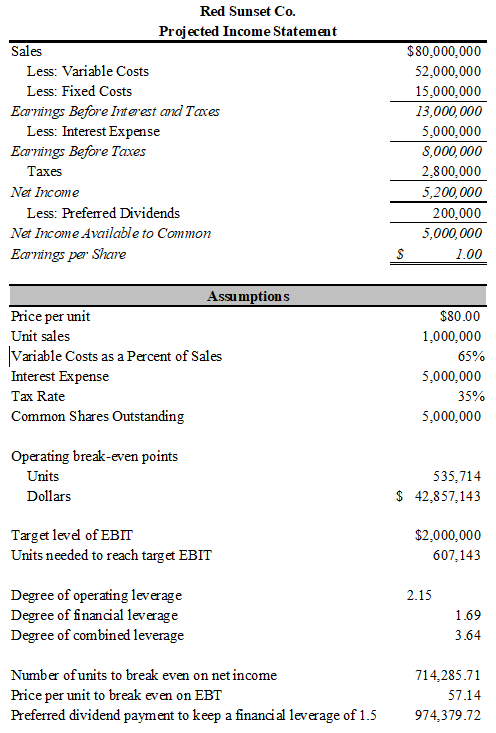

Red Sunset Co. manufactures mobile phones and wants to add a new model to its current line of products. The firm has estimated that the new phone’s selling price will be $80 and that variable costs would represent 65% of the sale price. Fixed operating costs are estimated to be $15M and the firm’s marginal tax rate is expected to remain at 35%. The firm also has forecasted that interest expenses associated with the new chip will reach $5M. The firm has 5M of common shares outstanding and forecasts a total preferred dividend payment of $200,000 for the next year. If Red Sunset Co. expects to sell 1M units of the new phone, then:

a) Create an income statement with the previous information.

b) Calculate the operating break-even point in both units and dollars.

c) How many units would Red Sunset Co. need to sell in order to achieve earnings, before interest and taxes of $2M?

d) Calculate the degree of operating, financial, and combined leverage.

e) Use the Goal Seek tool to determine the number of units that would allow Red Sunset Co. to break even in terms of its net income and the selling price to break even in terms of earnings before taxes. Also, determine with the same tool how much preferred dividends the firm would need to pay to keep a degree of financial leverage of 2.

You might also like to view...

Along with physical elements, the training context should include emotional elements.

Answer the following statement true (T) or false (F)

Assume Agri Products records sales transactions directly into the general journal using the periodic inventory method. Agri Products sold merchandise on account to Corn Producers, invoice no. 2787, $5,600 . The transaction would be recorded as

a. a debit to Cash and a credit to Sales. b. a debit to Sales and a credit to Cash. c. a debit to Accounts Receivable, Corn Producers and a credit to Sales. d. a debit to Sales and a credit to Accounts Receivable, Corn Producers.

The accounts with identification letters for Smart Delivery Services are listed below.LetterAccount TitleLetterAccount TitleACashISmart, DrawingBAccounts ReceivableJDelivery Fee IncomeCSuppliesKAdvertising ExpenseDPrepaid RentLEquipment Repairs ExpenseEDelivery EquipmentMRent ExpenseFOffice EquipmentNSalaries ExpenseGAccounts PayableOUtilities ExpenseHSmart, Capital??During the current month, the company completed the transactions listed below. Indicate the appropriate journal entry that needs to be recorded for each transaction by providing the account letter and amount. Some entries may need more than one debit and/or more than one credit. The first transaction is completed as an example. ??DebitCredit?TransactionLetterAmountLetterAmountA.The owner invested $25,000 cash in

the businessA$25,000H$25,000B. Purchased delivery equipment for $3,200 on account????C. Received a bill for $960 for equipment repairs that will be paid next month????D. Performed delivery services for $12,800; received $4,400 in cash immediately and the remainder was on account ????E.Issued check for $500 for a newspaper advertisement????F.Issued check for $750 for current month's utilities????G.The owner withdrew $1,500 cash for personal use????H.Received $900 on account from credit clients???? What will be an ideal response?

Which of the following is classified as in-store marketing?

A. Coupon B. Sample C. Premium D. Discount E. Rebate