Which of the following is most likely to be an increasing-cost industry?

a. An industry whose firms experience diseconomies of scale

b. An industry whose firms experience economies of scale

c. An industry that is a major buyer in the markets for the inputs it uses

d. An industry that is a very small buyer in the markets for the inputs it uses

e. An industry that is a major seller in the markets for its outputs

C

You might also like to view...

Gordon suggests that full indexation of production costs to nominal AD would solve the macroeconomic externality. However, individual firms would be unlikely to extend full indexation to their workers because

A) its local customers may not buy its products at the new price level. B) its suppliers may reside in foreign countries and are therefore, not subject to indexation. C) other competitor firms will not index their wages. D) All of the above.

Which is FALSE about perfect competition?

A) There are numerous sellers. B) Market entry and exit is unrestricted. C) There is no ability to set price. D) There is considerable product differentiation.

Fiscal policymakers may actually welcome some inflation for all of the following reasons except:

A. it weakens the independence of the central bank. B. interest payments tend to be fixed so the real interest payments are reduced. C. it reduces the real value of the national debt allowing governments to "default" on a portion of their debt. D. it potentially raises tax revenues.

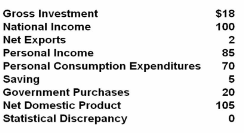

The gross domestic product for the above economy is:

A. $100.

B. $95.

C. $110.

D. $107.