Answer the following statement(s) true (T) or false (F)

1. To make the most accurate predictions about a stock's future price, one must look at both the past pattern of prices and the current price of the stock.

2. In an efficient market, the current price reflects all available information.

3. The past performance of a stock is the best guide to future performance.

4. A speculative bubble is characterized by systematic undervaluing of stocks.

5. Efficient financial markets are called so because they produce an amount of financial products that maximizes total surplus in the financial industry.

1. False

2. True

3. False

4. False

5. False

You might also like to view...

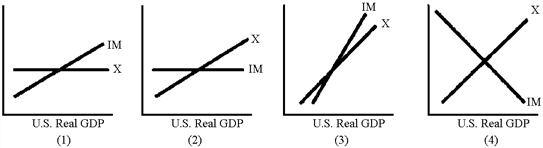

Figure 36-1

A. 1 B. 2 C. 3 D. 4

Which types of expenditures are autonomous?

The invisible hand is a notion from:

a. Marx b. Ricardo c. Keynes d. Mises e. none of the above

If in a fiscal year, the outlays > incomes

What will be an ideal response?