In a proportional income tax system

A) marginal tax rates are the same regardless of the level of taxable income.

B) marginal tax rates increase as the level of taxable income increases.

C) marginal tax rates decline as the level of taxable income declines.

D) everyone pays the same dollar amount in taxes.

Answer: A

You might also like to view...

If the price of coal, a close substitute for oil, decreases, then the

A. supply curve for oil will shift to the right. B. demand curve for oil will shift to the right. C. equilibrium price and quantity of oil will not change. D. demand curve for oil will shift to the left. E. supply curve of coal will shift to the left.

Suppose it costs a farmer $1.00 to produce 1 unit of corn, $2.10 to produce 2 units of corn, and $3.30 to produce 3 units of corn. What's the marginal cost of producing 3 units of corn?

A) 0 B) 30 cents C) $1.10 D) $1.20 E) $3.30

Consider the market for ride-on lawn mowers and the recent increases in the price of oil. The recent increase in the price of oil makes it more expensive to manufacture ride-on lawn mowers. An increase in the price of oil also makes it more expensive to run a ride-on mower. What factors of demand and/or supply are affected by the changing price of oil?

A. Price of related good, price of input B. Price of input, number of buyers C. Price of related good, expectations of future D. Price of input, income

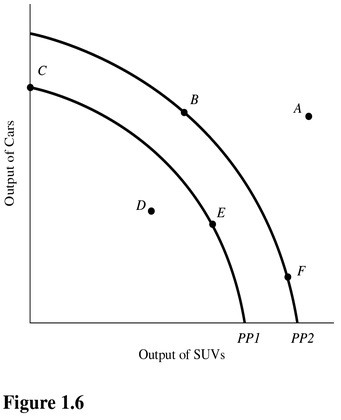

Using Figure 1.6, if an economy has the capacity to produce represented by PP1, then point E represents

Using Figure 1.6, if an economy has the capacity to produce represented by PP1, then point E represents

A. A change in technology. B. An efficient use of resources. C. A combination of cars and SUVs that is not attainable. D. A constant trade-off between cars and SUVs.