On January 1, 2019, First Street Sales issued $38,000 in bonds for $15,700. These are six-year bonds with a stated interest rate of 16% that pay semiannual interest. First Street Sales uses the straight-line method to amortize the Bond Discount. Immediately after the issue of the bonds, the ledger balances appeared as follows:

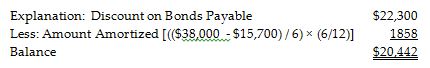

After the first interest payment on June 30, 2019, what is the balance of Discount on Bonds Payable? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) debit of $20,442

B) debit of $22,300

C) debit of $24,158

D) credit of $1858

A) debit of $20,442

You might also like to view...

Rachel saw her sister Rebecca being hit by a car. She rushed to help her and later accompanied her to the hospital. Unfortunately, several hours later her sister died. Rachel, who received psychiatric treatment as a result of the traumatic experience, sued the car driver for emotional distress. Which of the following is most likely to be true in this case?

A. Rachel will be awarded recovery because she bore witness to the accident during which her sister was killed. B. The courts will not allow recovery because Rachel suffered only emotional trauma with no visible signs of physical injury. C. The courts will allow recovery for battery because Rachel is related to the victim of the accident. D. Rachel is not entitled to recovery because she was not in the "zone of danger" created by the negligent act.

CJ's is a clothes retailer that grew from a single store into a chain over a few years

The key service characteristic during CJ's early years was a personalized customer relationship, and the company continues to collect information about its customers and maintain a database. Recently, however, CJ's has been losing customers to competitors as the expansion has made it difficult to personalize services. How can CJ's use its customer database to reactivate customer purchases?

Which of the following would be added to the balance per books on a bank reconciliation?

a. Deposits in transit b. Outstanding checks c. Service charges d. Notes collected by the bank

A marketing plan created for an end-user most likely addresses:

A. the business proposition. B. the features, advantages, and benefits of the product. C. how a reseller will sell the product once purchased. D. how the product can be used. E. forecasted profit and ROI.