"A $1,000 tax paid by a poor person may be a larger sacrifice than a $10,000 tax paid by a wealthy person" is an argument in favor of

a. the horizontal equity principle.

b. the benefits principle.

c. a regressive tax argument.

d. the ability-to-pay principle.

d

You might also like to view...

Two university graduates, Bill and Steve, worked for an advertising agency at an annual salary of $40,000 each for 3 years after they graduated. Then, they decided to quit their jobs and start a partnership that designs and builds Web sites

They rented an office for $12,000 a year and bought capital for $30,000. To pay for the equipment, Bill and Steve borrowed money from a bank at an annual interest rate of 6 percent. During their first year of operation, the partners' total revenue was $100,000. The market value of their capital at the end of the year was $20,000. If Bill and Steve do not design Web pages, their best alternatives are to return to their previous job. a) What is the firm's economic depreciation? b) What are the partnership's costs? c) What is the firm's economic profit in the first year of operation?

Explain briefly the following concepts:

(a) Increasing returns to scale (b) Decreasing returns to scale (c) Constant returns to scale

The time frame in which all factors of production can vary is

A) the short run. B) the intermediate run. C) the long run. D) indeterminate.

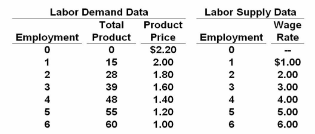

Refer to the given data. We can conclude that:

Use the resource demand data shown on the left and the resource supply data on the right in answering the following question:

A. both the product and resource markets are imperfectly competitive.

B. the resource market is imperfectly competitive, but the product market is purely

competitive.

C. both the resource and product markets are purely competitive.

D. the resource market is purely competitive, but the product market is imperfectly

competitive.