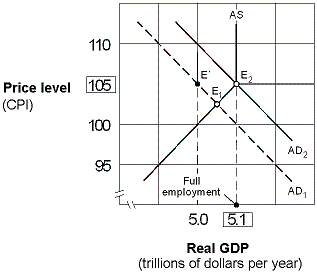

On the graph above, a permanent tax reduction, assuming that there is a permanent effect on aggregate supply, is likely to move the economy from point 1 to point ________

A) 2

B) 8

C) 6

D) 3

A

You might also like to view...

According to the contestable market model, if there are no barriers to entry or exit, the price an oligopolist sets will provide no economic profits in the long run.

Answer the following statement true (T) or false (F)

Exhibit 11-2 Aggregate demand and supply model

A. decreasing government tax revenue by approximately $33 billion. B. decreasing government tax revenue by $750 billion. C. increasing government tax revenue by $100 billion. D. increasing government tax revenue by approximately $33 billion.

To prevent bank runs and the consequent bank failures, the United States established the ________ in 1934 to provide deposit insurance

A) FDIC B) SEC C) Federal Reserve D) ATM

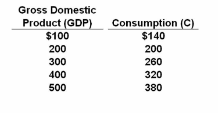

Refer to the data. The 10 percent proportional tax on income would cause:

Answer the question on the basis of the following before-tax consumption

schedule for an economy:

A. both consumption and saving to increase by larger and larger absolute amounts as GDP

rises.

B. both consumption and saving to increase by smaller and smaller absolute amounts as GDP rises.

C. consumption to decrease by larger amounts and saving to decrease by smaller amounts

as GDP rises.

D. no change in the amounts consumed and saved at each level of GDP.