Explain the concept of "quality gates" at the Cambridge plant of Lexus with an example

At the Cambridge plant, Lexus has taken quality control to a new level, with the introduction of "quality gates": checkpoints where items found to be of particular concern to customers (such as flawless vertical paint surfaces and the fit of headlights into the body of the vehicle) are noted and evaluated. At the welding area's quality gate, for example, welds are tested with hammer and chisel and alignments measured with jigs. Team members certify each vehicle's weld integrity by applying their initials in bright colors. These personal testimonials to care and quality will ride with the vehicles for their lifetimes, albeit under coats of paint or hidden away from the customer's eye. Then, at the end of the welding process, the bodies receive an even closer inspection, distinguished by that special human touch that makes Lexus so rare among car companies. Under an angled roof made up of light tubes, team members sweep their hands carefully across every inch of the vehicles' exteriors. With small, black abrasive squares in their gloved hands, they smooth out any remaining spots or irregularities.

You might also like to view...

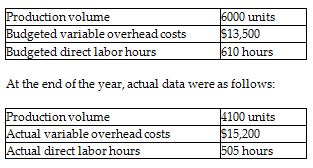

Stafford Company uses standard costs for its manufacturing division. Standards specify 0.1 direct labor hours per unit of product. The allocation base for variable overhead costs is direct labor hours. At the beginning of the year, the static budget for variable overhead costs included the following data:

How much is the standard cost per direct labor hour for variable overhead? (Round your answer to the nearest cent.)

A) $22.13 per direct labor hour

B) $32.93 per direct labor hour

C) $26.73 per direct labor hour

D) $24.92 per direct labor hour

The measurement principle, also called the cost principle:

A. Prescribes that a company report the details behind financial statements that would impact users' decisions. B. Prescribes that accounting information is based on actual cost. C. Means that accounting information reflects a presumption that the business will continue operating instead of being closed or sold. D. Prescribes that a company record the expenses it incurred to generate the revenue reported. E. Provides guidance on when a company must recognize revenue.

Department J had no work in process at the beginning of the period, 18,000 units were completed during the period, 2,000 units were 30% completed at the end of the period, and the following manufacturing costs were debited to the departmental work in process account during the period (Assuming the company uses FIFO and rounds average cost per unit to two decimal places): Direct materials (20,000

at $5 ) $ 100,000 Direct labor 142,300 Factory overhead 57,200 Assuming that all direct materials are placed in process at the beginning of production, what is the total cost of the departmental work in process inventory at the end of the period? A) $90,000 B) $283,140 C) $199,500 D) $16,438

Ralph gives his daughter, Angela, stock (basis of $8,000; fair market value of $6,000). No gift tax results. If Angela subsequently sells the stock for $10,000, what is her recognized gain or loss?

A. $0 B. $2,000 C. $4,000 D. $10,000