The non- free trade policy of the United States that affects many poor countries of the world the most is the

A. tariff on imported tires.

B. the proposed tariff on steel.

C. agricultural subsidies.

D. quota on wood products.

C. agricultural subsidies.

You might also like to view...

Each of the following explains why cost-benefit analysis is difficult except

a. there is no price with which to judge the value of a public good. b. surveys are often biased and unreliable. c. it is difficult to identify all factors that influence costs and benefits of public goods. d. government projects rarely have sufficient funding to complete them on time.

If an individual pays an additional $0.30 in taxes as a result of a $1.00 increase in income, then that individual must have a(n) __________ tax rate of 30 percent

A) average B) fixed C) total D) marginal

In January 2009, the President submitted a bill to Congress in order to stimulate the economy and increase employment. The legislation was passed in March 2009, and the spending occurred from June 2009 to March 2011. As a result

A. the full effect of the fiscal policy change would not be felt until after March 2011 because of the effect time lag. B. the full effect of the fiscal policy change would be felt when the last of the funds were spent by the government. C. the full effect of the fiscal policy change would be felt by March 2011 because people anticipated the spending and changed their behavior accordingly. D. the full effect of the fiscal policy change would not be felt until after March 2011 because of the recognition time lag.

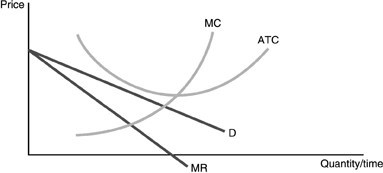

Refer to the above figure. Economic profits for this firm are

Refer to the above figure. Economic profits for this firm are

A. negative. B. zero. C. positive. D. undetermined without more information.