In the United States, which of the following is an example of a government-inhibited good?

A. education

B. cocaine

C. sports stadiums

D. museums

Answer: B

You might also like to view...

Some economists have proposed making the tax treatment of employer-provided health insurance the same as the tax treatment of individually purchased health insurance and out-of-pocket health care spending

Such changes would make it more likely that A) insurance deductibles would decrease. B) employers would provide more generous medical coverage to their employees. C) consumers would pay prices closer to the actual costs for routine medical care. D) the quantity of medical services demanded would increase.

The substitution effect will never induce a consumer to buy more of a good when its price increases

a. True b. False

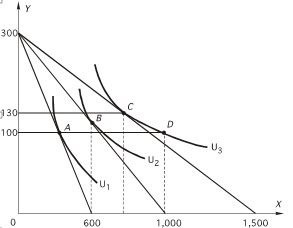

According to the following graph, if U2 is the maximum attainable utility, the price of X is The price of Y is $50.

The price of Y is $50.

A. $10. B. $25. C. $15. D. $20. E. none of the above

The velocity of money ________ be affected by how frequently workers are paid, and ________ be affected by the development of new financial instruments, such as interest-bearing checking accounts.

A. cannot; can B. can; can C. can; cannot D. cannot; cannot