Compare and contrast the predictions of the Heckscher-Ohlin and classical models about likely trading partners of various countries with the predictions of the Linder hypothesis

What will be an ideal response?

Both the classical and the HO models argue that the gains from trade emanate from different autarky relative prices. Consequently, differences in technology or factor endowments would seem to imply the possibility to exploit these gains. Linder argues that countries with similar standards of living (i.e. similar factor endowments or technologies) will produce similar types of goods and hence benefit by trading extensively, due largely to the availability through trade of an increased variety of goods.

You might also like to view...

Who pays the interest on government debt for the money it borrows today?

A) future generations of taxpayers B) the Congressional Budget Office C) the Federal Reserve D) The government does not pay interest on money it borrows.

Due to adverse selection, very few lemons will be sold in the market for used cars

Indicate whether the statement is true or false

A person starts practicing poisonous snake charming after signing a contract with a health insurance company. This is an example of

A) moral hazard. B) adverse selection. C) signaling. D) screening.

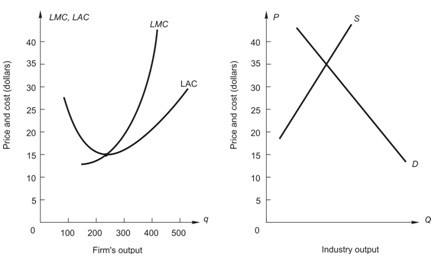

Below, the graph on the left shows long-run average and marginal cost for a typical firm in a perfectly competitive industry. The graph on the right shows demand and long-run supply for an increasing-cost industry. If this were an increasing cost industry, what would be the price when the industry gets to long-run competitive equilibrium?

If this were an increasing cost industry, what would be the price when the industry gets to long-run competitive equilibrium?

A. $35 B. between $35 and $15 C. below $15 D. above $35 E. $15