Financial markets:

A. enable buyers and sellers to exchange financial instruments but not risk.

B. do not allow for the transfer of risk but do help reduce it.

C. only allow the transfer of risk through derivative securities.

D. enable buyers and sellers to exchange risk by buying and selling financial instruments.

Answer: D

You might also like to view...

If the price level increases, but workers' money wage rates remain constant,which of the following is TRUE?

I. The quantity of labor demanded will increase. II. The real wage rate will decrease. III. The demand for labor curve shifts rightward. A) I only B) I and II C) II and III D) I, II and III

Comment on the ability of a credible nominal anchor to allow policy makers to exploit a short-run trade-off between unemployment and inflation

What will be an ideal response?

Suppose the market demand for milk is Qd = 150 - 5P. Additionally, suppose that a dairy's variable costs are VC = 2Q2 (where Q is the number of gallons of milk produced each day), its marginal cost is MC = 4Q and there is an avoidable fixed cost of $50 per day. In the long run there is free entry into the market. Suppose the demand for milk doubles. If in the short run the number of firms is fixed and their fixed costs are sunk, what is each of the active firms' profit per unit in the short run equilibrium?

A. $3.67 per unit B. $20.33 per unit C. $24.00 per unit D. $6.67 per unit

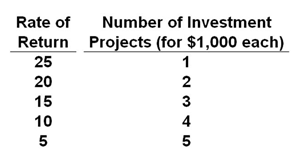

Refer to the below table and information. The number of investment projects this firm would undertake will decrease from 4 to 2 if the interest rate in the loanable funds market:

The following table shows the projected rate of return and number of investment projects which might be undertaken by a small firm. Each project requires an investment of $1,000.

A. Increases from 10 percent to 20 percent

B. Decreases from 20 percent to 10 percent

C. Decreases from 15 percent to 10 percent

D. Increases from 15 percent to 20 percent