When the Fed sells bonds, the money supply:

A. Selling bonds does not affect the money supply.

B. sometimes rises and sometimes falls.

C. contracts.

D. expands.

Answer: C

You might also like to view...

The U.S. dollar exchange rate, e, where e is the nominal exchange rate expressed as Japanese yen per U.S. dollar, will depreciate when:

A. Japanese consumers increase their preference for U.S. cars. B. the U.S. Federal Reserve eases monetary policy. C. real GDP in the U.S. decreases. D. the Bank of Japan eases monetary policy.

If a lender wants to earn a real interest rate of 3% and expects inflation to be 3%, he/she should charge a nominal interest rate that:

A. is at least 7%. B. equals the real rate desired less expected inflation. C. equals the real rate desired plus expected inflation. D. is anything above 0%.

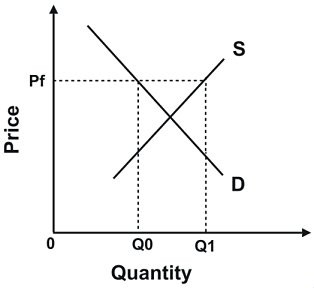

Refer to the following graph. Suppose this graph represents the market for cheese. In order to keep the price of cheese at Pf, government must:

Suppose this graph represents the market for cheese. In order to keep the price of cheese at Pf, government must:

A. prevent the excess supply from reaching the market. B. devise a mechanism to ration cheese to consumers. C. cause the demand for cheese to decrease. D. cause the supply of cheese to increase.

The more product differentiation in the market, the ________ the firm specific demand curve. The less product differentiation in the market, the ________ the firm specific demand curve.

A. steeper; flatter B. flatter; steeper C. more concave; more convex D. more convex; more concave