Answer the question.Suppose you are 25 years old and would like to retire at age 65. Furthermore, you would like to have a retirement fund from which you can draw an income of $359,052 per year-forever! How can you do it? Assume a constant APR of 5% compounded monthly.

A. Deposit $3605.86 per month.

B. Deposit $4174.75 per month.

C. Deposit $5654.29 per month.

D. Deposit $4705.73 per month.

Answer: D

You might also like to view...

The amount of future cash flows is an accounting measurement that is considered relevant for decisions made by financial statement users.

Answer the following statement true (T) or false (F)

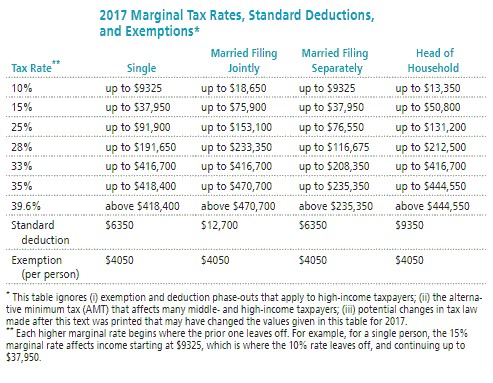

Solve the problem. Refer to the table if necessary. Kelsey earned $58,750 in wages. Conner earned $58,750, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

Kelsey earned $58,750 in wages. Conner earned $58,750, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

A. Kelsey: 0.0% Conner: 4.4% B. Kelsey: 19.7% Conner: 11.6% C. Kelsey: 13.3% Conner: 2.7% D. Kelsey: 21.0% Conner: 2.7%

Decide whether the statement makes sense. Explain your reasoning.My mortgage payment is $1500 per month so I will have a tax deduction of

What will be an ideal response?

Write an equation in slope-intercept form of a line satisfying the set of conditions.m = 5, y-intercept (0, -4)

A. y = 5x - 4 B. y = 5x + 5 C. y = 5x + 4 D. y = -4x - 5