Hadley and Ilene are accountants who work together. Hadley and Ilene can limit their potential liability for each other's misconduct by organizing their business as

A. a limited liability partnership.

B. an unincorporated professional association.

C. an unofficial co-practice.

D. a sole proprietorship.

Answer: A

You might also like to view...

Revenue is equal to the cash received by a company during an accounting period

Indicate whether the statement is true or false

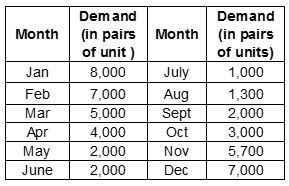

Consider the estimated aggregate demand for a company’s ski product line for the upcoming year in the following table. Calculate the ending inventory level for January under a level production strategy. Assume the beginning inventory for January is 8,000 units.

A. 3,000

B. 5,000

C. 4,000

D. 5,500

Which one of the following is NOT necessary to identify the optimal maintenance policy?

A) historical data on maintenance costs B) cost of performing the analysis C) breakdown probabilities D) breakdown occurrences E) repair times

Mike goes to the market and haggles for a price that is less than the vendor's cost. This is an example of ________ negotiating.

A. maximal B. win-lose C. Western D. All of the choices can be correct.