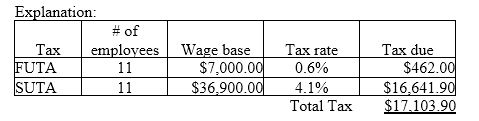

Deschutes Companies located in Oregon has a SUTA tax rate of 4.10% and a wage base of $36,900. During the last calendar year, the company paid $393,750 in wages and salaries for 11 employees. What is the total of the FUTA and SUTA tax liabilities for Deschutes Companies? (Assume that all employees have exceeded the FUTA and SUTA wage bases.)

A) $17,103.90

B) $16,709.50

C) $18,323.40

D) $15,785.60

A) $17,103.90

You might also like to view...

Assume that a corporation in the 25 percent tax bracket purchases a piece of equipment for $67,000 with a ten-year useful life and no estimated salvage value. The corporation uses straight-line depreciation for book purposes and double-declining-balance depreciation for tax purposes. The first-year temporary difference, using income tax allocation procedures, would result in a

a. debit to Deferred Income Taxes of $1,675. b. credit to Deferred Income Taxes of $6,700. c. credit to Deferred Income Taxes of $1,675. d. debit to Deferred Income Taxes of $6,700.

. ______ are followers who stand aside from their leaders.

Fill in the blank(s) with the appropriate word(s).

A conclusion depends upon your purpose in describing the topic. If you write "This computer carries a 10-year warranty on parts and labor," your purpose is a

A) Guarantee. B) Testimony. C) Comparison/contrast. D) Sales.

Top executives tend to focus their attention on which type of forecasts?

A) short-range B) intermediate-range C) long-range D) weather E) the forecast for the next day's absentee levels