Well-established property rights and a pro-business climate are a step in the right direction, but ultimately they do little to encourage economic growth.

Answer the following statement true (T) or false (F)

False

Land, property, and contract rights have to be established before farmers will voluntarily improve their land or invest in agricultural technology. Unleashing the 'animal spirits' of the marketplace is also critical. People respond to incentives. If farmers see the potential for profit-and the opportunity to keep that profit-they will pursue productivity gains with more vigor. Finally, pro-business climates encourage the capital investment, the entrepreneurship, and the human capital investment that drive economic growth.

You might also like to view...

The ability to use the too-big-to-fail policy was curtailed by the passage of the FDICIA

To use this action today, the FDIC must get approval of a two-thirds majority of both the Board of Governors of the Federal Reserve and the directors of the FDIC and also the approval of the A) Secretary of the Treasury. B) Senate Finance Committee Chairperson. C) President of the United States. D) governor of the state in which the failed bank is located.

If two economists disagree on an issue and their disagreement is based on personal value judgments, then this controversy is a normative one

a. True b. False

Two members of the Kenyan parliament from coffee-growing areas said that no firm should have a monopoly to market Kenyan coffee. The retail coffee company Tetu Coffee has sparked a storm in the industry by promising to earn the country Sh400 (Kenyan Shilling) billion annually if given exclusive licenses to market Kenyan coffee. The members of parliament said the coffee bean farmers should be free to sell their beans to the highest bidder.If all coffee growers had to sell their produce to Tetu Coffee, this would be a(n):

A. price-discriminating monopoly. B. oligopoly. C. monopsony. D. natural monopoly.

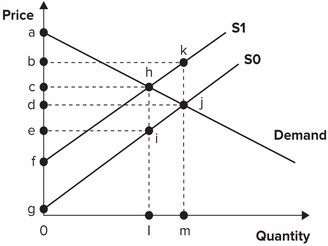

Refer to the graph shown. Assume the market is initially in equilibrium at point j in the graph but the imposition of a per-unit tax on this product shifts the supply curve up from S0 to S1. The effect of the tax is to raise equilibrium price from:

A. c to b. B. d to b. C. e to c. D. d to c.