What is the significance of the financial life cycle?

A) To help you to compare your situation with other people's situation

B) To better understand how your financial needs will most likely change over time

C) To allow you to be more proactive in dealing with expected changes in the future and take steps today to prepare for them

D) To help you realize that your original plan is sufficient and doesn't need to change

E) Both B and C are significant aspects of the financial life cycle.

Answer: E

You might also like to view...

Dividends in Arrears

a. is a liability account. b. appear in the notes to the financial statements. c. is a stockholders' equity account. d. is a contra-stockholders' equity account.

Which type of molecule will require energy to cross the cell membrane?

A. nonpolar molecules B. oxygen C. Na+ D. carbon dioxide

Answer the following statements true (T) or false (F)

1. Managerial accounting focuses on providing information for internal planning and control. 2. Financial accounting prepares reports for internal purposes, whereas managerial accounting provides information to external stakeholders. 3. Financial statements prepared for investors and creditors often include forward-looking information because they make decisions based on a company's future prospects. 4. Managerial accounting reporting by a public firm is required to follow the rules of GAAP. 5. Planning requires managers to look to the future and establish goals for the business.

Metallic Engineering, Inc., a manufacturer of fabricated aluminum products for aerospace, engineering, automotive, and custom industrial applications, is calculating its WACC. The firm’s common stock just paid a dividend of $1.5 per share and now is selling for $30. The firm’s financial staff estimates the company’s new product will generate an unusual high dividend growth rate of 17% for four years. After this period of time, the dividend growth rate will decline to 3% during a transition period of 3 years, rather than instantaneously. The firm’s debt-to-equity ratio is 3/4 and the flotation costs for new equity will be 7%. Also, the firm has a payout ratio of 60% and 20M of common shares of stock outstanding.

a) Based on the information above, determine the firm’s estimated retained earnings and the associated break-point.

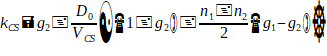

b) Calculate the firm’s cost of retained earnings and the cost of new common equity. Hint: use the required rate of return kCS derived from the H-Model formula in Chapter 9 as follows:

c) If Metallic Engineering’s after-tax cost of debt is 5%, determine the WACC with retained earnings and new common equity.