The percentage of the burden of an excise tax that is borne by sellers generally depends on the

a. size of the tax.

b. relationship between the elasticity of demand and the elasticity of supply.

c. elasticity of demand.

d. elasticity of supply.

b

You might also like to view...

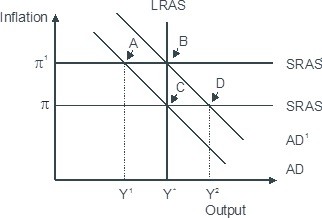

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

A bond has a current market value of $800. The holder of the bond will receive a single payment of $1,000 one year from now. The interest rate is 10 percent. The effective yield on the bond is:

A) $200. B) 10 percent. C) 25 percent. D) negative. E) The yield cannot be determined with the information provided.

The difference between positive statements and normative statements is that

A. a positive statement is a statement of fact and a normative statement involves value judgments. B. normative statements are provable while positive statements are not. C. a positive statement involves a value judgment and a normative statement is a statement of fact. D. value judgments are made in normative statements but assumed in positive statements.

QE3 followed QE2 and Operation Twist. Which of the following best explains how QE3 differed from the other two in order to make it more effective?

A. QE3 promised a much larger expansion of reserves. B. QE3 gave a much stronger forward commitment as to when the policy would be complete. C. QE3 carried much more force in getting banks to lend reserves. D. QE3's completion was tied to economic objectives, rather than specific dates.