Whenever a bank-customer relationship is established, certain contractual rights and duties arise.

Answer the following statement true (T) or false (F)

True

You might also like to view...

What is the importance of developing a thorough media list? What are the two essential parts of a connector list?

What will be an ideal response?

Two cities that have equal populations are 40 miles apart. Based upon Reilly's law, the point of indifference _____

a. is midway between each city b. is 10 miles from the first city c. is 15 miles from the first city d. cannot be determined from the information provided

In which order will assets be listed in a balance sheet??

A. ?In ascending order of the value of the asset B. ?In alphabetical order C. ?In ascending order of the date of purchase of asset D. ?In order of liquidity E. ?In order of importance for the company

Prepare Plax's Consolidated Statement of Financial Position as at December 31, 2018.

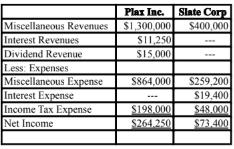

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the

straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

What will be an ideal response?